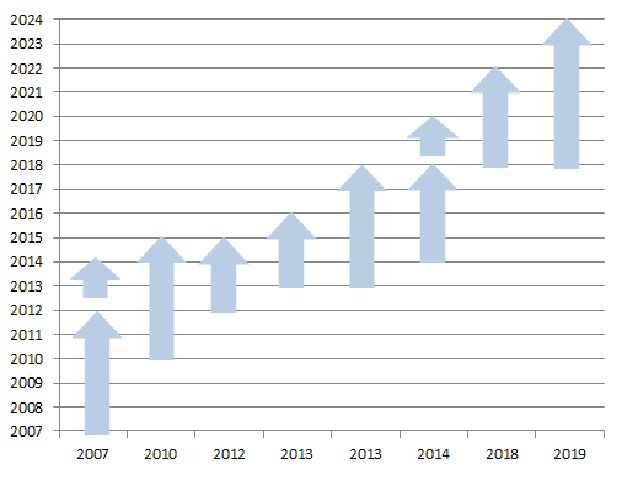

Romania has a new target date to join the eurozone:2024. That was an occasion for me to update the graph that tracks the many deadlines to join the eurozone that Romania has had over the years. The arrows start from when the announcement was made and stop in the expected year of accession. As you can see, based on announcements made by 2013, we should have been in the eurozone. This is a graph which is also an opportunity to show how seriously the topic of joining the eurozone has been addressed by various decision-makers over time. (I left their names out not to elicit more “sympathy”)

Let me be clear. This should be first and foremost an economic decision. The pains of the original sin which allowed too large a eurozone to be created based mainly on politics, are felt by most eurozone countries and the cracks in the foundation emerged and grew particularly during the crisis. Under these conditions, the economic criteria came to prevail and will continue to do so over politics. And not only are they dominant, but they were tightened as besides the nominal convergence criteria (the famous Maastricht criteria), the real convergence criteria that show the economic competitiveness of a country come also under scrutiny. But apart from the frivolous approach that a mainly economic decision has been given having been mistaken for a political one, the many target dates also show something else: the appeal that the single currency holds for Romanians, regardless of which group they belong to. Except that each category has its own motivation, sadly for the wrong reasons.

Let me be clear. This should be first and foremost an economic decision. The pains of the original sin which allowed too large a eurozone to be created based mainly on politics, are felt by most eurozone countries and the cracks in the foundation emerged and grew particularly during the crisis. Under these conditions, the economic criteria came to prevail and will continue to do so over politics. And not only are they dominant, but they were tightened as besides the nominal convergence criteria (the famous Maastricht criteria), the real convergence criteria that show the economic competitiveness of a country come also under scrutiny. But apart from the frivolous approach that a mainly economic decision has been given having been mistaken for a political one, the many target dates also show something else: the appeal that the single currency holds for Romanians, regardless of which group they belong to. Except that each category has its own motivation, sadly for the wrong reasons.

The public, for instance, sees the adoption of the euro to be similar to redenomination, when we transitioned to the “hard RON” by using new banknotes with four zeros scratched off. Romanians are already mentally ready to get rid of the RON for the euro, given the high degree of eurorization of the economy tacitly approved by the relevant domestic institutions. Ironically, encouraging the use of the local currency in transactions has not been a priority for the institutions in charge over the past decades. So a series a transactions are already made in euro or indexed to it. There is just a small step from that to using it on a day-to-day basis, as the risks of a premature switch to the euro are not fully grasped by the public at large.

Neither are they understood by the second category: the naïve decision-makers. This group includes those in positions of power and decision-making who see the joining of the eurozone as a “free lunch”. They think that the move will help us leave foreign exchange volatility, especially currency depreciation behind, and grant us easy access to cheap euro area bank lending. Moreover, the government would be able to borrow cheaply from the financial markets, not to mention the likely European Central Bank`s purchases of government bonds in crises. So bye bye IMF…

The picture is more complicated than that. The very tight budget policy of a country sitting in the waiting room of the euro area and envied by some of our leaders these days for its Monetary Council that guarantees a fixed exchange rate, gives us an idea of the strictness required by the club. The results of putting budgetary wisdom aside were illustrated by another country, already in the eurozone, which paid with extremely painful economic adjustments the delusion that once in the club (and manipulating economic data…) any irrational economic behavior is allowed. And as adjustments in the euro area are no longer possible via the exchange rate or inflation, they must be carried out by the (political!) decision of cutting wages and pensions, redundancies and cuts to the education and health budgets. The warmongering Prime-Minister Tsipras, brought to power by a wave of popular discontent, had to put his sword back in its place rather quickly and shelve populist measures to prevent a disastrous crash out of the eurozone.

It is worth noting that our fellow citizens who favor a quick accession to the eurozone are ignorant of the fact that in the years prior to accession, the Romanian central bank, the NBR, will have to leave the currency float without intervening on the foreign exchange market, that is without the very interventions which are, ironically, called for today by some accession proponents.

No. Joining the euro area is no free lunch. On the contrary. It needs plenty of economic rigour and higher-quality governance. None of which is easy to achieve. That leads us to the third category.

This includes sophisticated opinion leaders whom I hear in the media, but also during more or less open meetings. These are educated and informed people, guilty, however, of a serious error: they mistake Romania`s accession to the European Union for that to the eurozone and say that the main benefit is an alleged accelerated convergence with more developed countries by putting the country on auto-pilot that would offset the country`s poor governance. They also talk about increased economic rigour and ridding the NBR of the temptations of political influence.

Indeed, after joining the EU, convergence covered several directions: justice, politics, economics. Assessments and statistics alike showed that the gap separating Romania and the older Member States decreased following the accession. That was hardly a surprise! Other countries joining before Romania, went through a similar convergence process. Even though Romania was less ready when it joined, the mechanism worked also in its case and sped up growth and progress. As a matter of fact, missing out that window of opportunity would have delayed its accession and eventually held back its development by years, if not a decade.

Joining the eurozone is a whole new ballgame and truth be told, does not result in much convergence. Analyzing economic changes reported using Germany as a benchmark shows that, in fact, the trajectories of the other countries, whether Greece, Italy, Spain or even France tended to be divergent. What else is there to say about rigour. There are enough famous cases where the adoption of the euro did not result in sounder economic approach to how some of its members are run. Under these circumstances, the arguments of those invoking the benefits of accelerated convergence by joining the eurozone prematurely, are completely unconvincing and a risky bet at the expense of the economy and the public.

The latest Report to Substantiate the National Plan for Joining the Eurozone is a paper that fairly captures the fact that accession is an extremely complex process which requires Romania to set a series of interim development goals and fundamentally change how it manages its economy and budget. If all that is achieved, then accession will come as a natural consequence of its economic development whereby the gaps to other members are much narrower than they are now.

The bad news is that, under the coordination of some of the Report`s signatories, Romania is going in the opposite direction to that expected, and currently meets just one Maastricht criterion for joining the eurozone.

Have a nice weekend!